Analyst Calls Zynga an Underperformer Days Before Its IPO

Sterne Agee has initiated coverage of Zynga with an underperform rating before the San Francisco social games company even has a chance to go public.

Zynga, which makes some of the better-known games on Facebook, like FarmVille and CityVille, is seeking to raise $1 billion in a public offering later this week. If successful, it will be the largest IPO from a U.S. Internet company since Google raised $1.7 billion in 2004.

Zynga, which makes some of the better-known games on Facebook, like FarmVille and CityVille, is seeking to raise $1 billion in a public offering later this week. If successful, it will be the largest IPO from a U.S. Internet company since Google raised $1.7 billion in 2004.

But not everyone is buying the company’s growth story.

Sterne Agee analyst Arvind Bhatia said the bottom line is that the company’s hyper-growth is not sustainable, and that new titles, like CastleVille and Mafia Wars 2, are not tracking as well as such classics as FarmVille, or even CityVille.

That’s in steep contrast to bold claims made by Zynga as recently as last week that it will be able to double the number of paying customers it currently has.

But Bhatia argued that Zynga remains too dependent on Facebook despite efforts to diversify to mobile and to build its own game network.

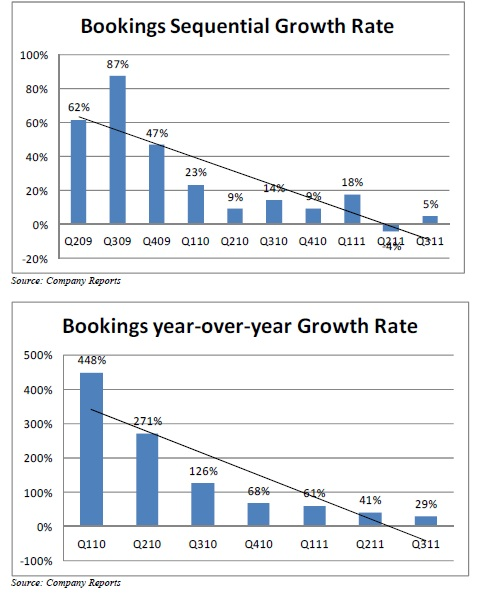

Bhatia used a couple of pretty charts to help make his case. He tracked bookings over several periods to see how revenues were trending. Bookings can be a more accurate picture of the company’s current performance, rather than revenues, which may account for virtual goods sold over several quarters.

Bhatia’s report throws cold water on a couple of positive stories that emerged over the past couple of days pointing out that Zynga is currently dominating the social games charts, with its titles now holding all of the top five spots.

According to AppData, the top games are: CityVille, CastleVille, FarmVille, Zynga Poker and Words With Friends. Electronic Arts’ The Sims Social ranks No. 6.

Unfortunately, the daily rankings can be easily influenced. If a company has the budget, it can push titles to the top through the use of marketing campaigns. It may not be sustainable, but for a short period of time, it’s conceivable. Although, to be clear, there’s no way to tell if Zynga has increased its marketing in its run-up to an IPO.

The question remains whether Zynga will be able to achieve its goal of selling 100 million shares at $8.50 to $10 apiece.

Bhatia, who doesn’t own any shares and doesn’t do any investment banking work for the company, says a more appropriate price target is probably $7 a share.