AOL Beats the Street, but Domestic Ads Droop Again

If you bet on AOL at the beginning of 2012, you ended up picking one of the hottest stocks in tech. Shares are up 135 percent this year.

If you bet on AOL at the beginning of 2012, you ended up picking one of the hottest stocks in tech. Shares are up 135 percent this year.

Now we’ll see if Tim Armstrong can keep it going with his third-quarter results. The good news: AOL beat Street estimates for revenue and earnings, and its revenue number didn’t decline — the first time that has happened in seven years.

Not-so-good news: The company’s key domestic display number slipped 3 percent, and overall display sales were down 1 percent. AOL’s overall ad business was up 7 percent in the last year, though, pushed up by AOL’s network ads and its search business.

Here’s AOL’s explanation of what happened to display sales. Note the shout-out to Patch, Armstrong’s controversial bet on local: “Domestic display revenue declined due to a reduction in the sale of reserved inventory, but was partially offset by an increase in the number of impressions sold through Ad.com, growth in reserved pricing due to the increased sales of premium formats and video and strong revenue growth from Patch.”

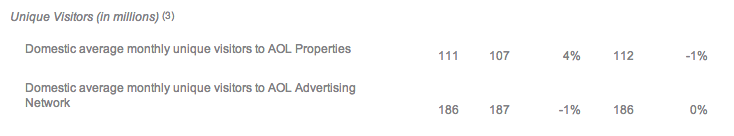

Another positive sign for Armstrong: He has reversed the declining traffic numbers for the sites AOL owns. Those are up 4 percent over the last year:

We’ll see how Armstrong positions the company to investors during his conference call, which starts at 8 am.