Amazon’s E-Book Business Is Up 70 Percent, but It’s Still Not Disclosing Kindle Sales

Amazon is still not saying how many Kindles it is selling, even though the e-book business has become a “multi-billion dollar category” for the retailer.

But whatever those sales numbers were, they would have been higher last year if Amazon hadn’t sold out of its flagship e-reader, said Amazon’s CFO Tom Szkutak during the company’s earnings call today.

But whatever those sales numbers were, they would have been higher last year if Amazon hadn’t sold out of its flagship e-reader, said Amazon’s CFO Tom Szkutak during the company’s earnings call today.

In response to an analyst’s question about why the company’s revenue was lighter than expected in Q4, Szkutak named a number of reasons.

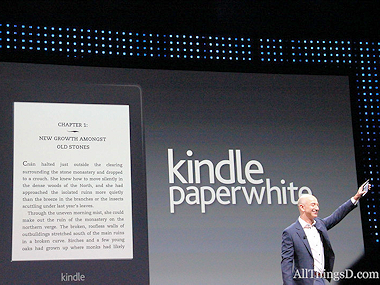

For one, he said, sales of consumer electronics, including TVs, MP3s and digital cameras, fell short of expectations. But also, he said, it had to do with shortages of the Kindle Paperwhite.

“We are thrilled to have Paperwhite in our lineup — it’s the best e-reader out there, but we couldn’t keep up with demand,” he said. “We would have had more sales in Q4 if we could keep up with demand.”

“The team is working hard to have good stock going forward on that product,” he added.

Amazon is notorious for not commenting on the performance of its hardware business, and that policy didn’t change this quarter. But in Amazon’s earnings release, Amazon’s CEO Jeff Bezos did open up a little bit about the company’s e-book business as a whole.

“We’re now seeing the transition we’ve been expecting,” he said. “After five years, eBooks is a multi-billion dollar category for us and growing fast — up approximately 70 percent last year. In contrast, our physical book sales experienced the lowest December growth rate in our 17 years as a book seller, up just 5 percent. We’re excited and very grateful to our customers for their response to Kindle and our ever expanding ecosystem and selection.”

Some critics will not consider that enough information, given the size of the business.

After all, without knowing unit sales, it makes it extremely difficult for analysts to compare Amazon to other tablet makers, namely Apple. But in some respects, e-book sales is a better measurement to track Amazon’s performance. That’s because it makes little to no profit on the hardware, and instead emphasizes the lifetime value of the customer.

By emphasizing content sales — and not unit sales — Amazon is under less pressure to get customers to continually upgrade their devices to generate more revenue. Put another way, a three-year-old Kindle can generate as much revenue as a brand new one. If Amazon disclosed device sales, analysts and investors would be closely tracking that metric for signs of growth.

Amazon also deploys this loss-leader strategy for Amazon Prime, which gives members free two-day shipping as well as access to free streaming video and free e-books. On the call, Szkutak cautioned that it’s still early, but that those freebies are beginning to drive additional revenue.

“The percentage of Prime customers who are watching free content has gone up dramatically,” he said, “And, they are purchasing paid content. They are watching for free, but they are also paying for new content.”