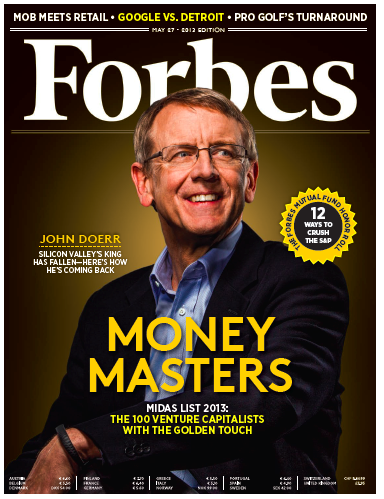

Accel’s Breyer Leads Forbes Midas List of Top Tech Investors Again, While Kleiner’s Doerr Leads in Media Scrutiny

Forbes magazine put out its much-watched Midas List today, which is kind of the Oscars for venture capitalists in tech. (Caveat: Think more khakis and dudes than glitz and glamour.)

On the Top 10 list of 100 of the best-performing and most influential tech investors, Jim Breyer of Accel Partners and Marc Andreessen of Andreessen Horowitz led the list at No. 1 and No. 2, as they did last year. And several others in last year’s list remained on it: Peter Fenton of Benchmark Capital, Greylock Partners’ Reid Hoffman, and also David Sze, Peter Thiel and Bessemer Venture Partners’ Jeremy Levine.

Accel scored well on the rest of the list with nine partners named; Sequoia Capital had six VCs on the list; Benchmark, Greylock and New Enterprise Associates got five slots; Bain Capital Ventures, Bessemer, Kleiner Perkins and Meritech Capital Partners had four; and Andreessen Horowitz, Institutional Venture Partners and Venrock each had three.

As usual, there were few women on the list — only three — reflecting the lack of gender equality in the top tier of the VC business, which solidly remains a boy’s club, despite a lot of noise about changing it (see the pictures here and become depressed once again). Those women who did manage to get on the Midas List were Jenny Lee at GGV Capital, who jumped from No. 94 to No. 36; Kleiner Perkins’s Mary Meeker, who dropped from No. 42 to No. 47; and Theresia Gouw of Accel at No. 82, up from No. 92.

One notable part of the massive Forbes package of VCs on parade was the intense and multipart focus on the travails of Kleiner Perkins and its longtime leader and legendary VC John Doerr. Doerr clocks in at No. 26 on the list, dropping from No. 12 last year, a significant fall.

He does address the nagging issues at the storied firm, including ill-conceived investments in clean tech, a late-to-the-game move into social media, and even its big stake in stock-declining online gaming giant Zynga, in a video (below) and in several pieces, one of which is titled ““John Doerr’s Plan To Reclaim the Venture Capital Throne.”

More like “Game of Thrones” from reading it; there is another, more critical article in the New York Times that appeared yesterday. That piece focused on Kleiner’s investment in the troubled green-car startup, Fisker Automotive, and also the firm’s ongoing sex-discrimination lawsuit with former partner Ellen Pao.

“It was a challenging year, one of my more challenging years in the venture business,” said Doerr to Forbes.

Indeed, although Forbes does hand Kleiner a hey-we-have-some-sharpie-young-folks-here-too! gimme with its focus on “new generation” partners Megan Quinn and Mike Abbott in an interesting Q&A, as well as yet another piece on Kleiner supporters — such as Google’s Eric Schmidt — touting the firm as perhaps down but definitely not out in the “mojo” department.

“John always wins eventually, and the reason he always wins eventually is because he has the processing power and human energy,” Schmidt told Forbes. “Whatever the set of challenges, he will drive the change in the firm. They’ll have a crisis meeting and another crisis meeting, but he will do it. It may be messy but he will get them there.”

Presumably, if Doerr and team can get some mileage out of its Twitter investment next year and somehow turn around Zynga’s moribund stock. (Kleiner has held on to a pile of it, which is why Doerr recently joined the board that already had Kleiner’s Bing Gordon on it.)

On problem for Kleiner, and boon to others like Accel and Greylock, was that the firm was not early in Facebook, whose IPO — as rocky as it was — gave many VCs making the top of the Midas List the needed turbocharge in terms of performance. Other key companies to help VCs look good this year, according to the Forbes report: Workday, LinkedIn and Skype.

Here’s Doerr, who is indeed a legend, even if more bruised and battered this year, talking about it all to Forbes’s Connie Guglielmo, in the video interview:

Speaking of media attention, here’s a more provocative video interview by Forbes with Sequoia’s Doug Leone (No. 4, up from No. 18 last year), in which he takes aim at VC firms that do too much self-promotion — three guesses which pioneering browser inventor he is referring to here, and the first two don’t count. He called it an “embarrassment,” although Sequoia did hire an excellent PR person from Google this year — nonetheless making the point that the focus should be on entrepreneurs and not investors.

Except, of course, when it comes to scoring high on the Midas List.