File Under #Finally: Twitter Unveils $1 Billion IPO, Showing Growing Revenue but No Profits

Not even a government shutdown could stop Twitter from its appointed IPO.

Today, the social microblogging company that started out its life as another product altogether unveiled its S-1 documents for its public offering of $1 billion. Its symbol will be TWTR, but Twitter did not say where its stock would be traded.

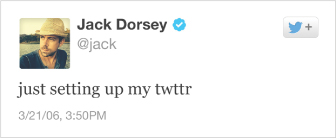

In its filing, the company went very cute, with an image of its first tweet by co-founder and Twitter creator Jack Dorsey, noting, “Twitter was born on March 21, 2006 with just 24 characters.”

It also included images of tweets from everyone from President Barack Obama to Wheat Thins to the one from Clarence House announcing the new royal baby in England.

More importantly, this is the first look at the business of the privately held San Francisco-based Twitter. Revenue for 2012 was $316.9 million. For the first half of 2013, $253.6 million.

The company lost $79.4 million in 2012 and lost $69.3 million in the first half of 2013.

But, on an adjusted basis, Twitter noted in its filing:

“From 2011 to 2012, revenue increased by 198% to $316.9 million, net loss decreased by 38% to $79.4 million and Adjusted EBITDA increased by 149% to $21.2 million. From the six months ended June 30, 2012 to the six months ended June 30, 2013, revenue increased by 107% to $253.6 million, net loss increased by 41% to $69.3 million and Adjusted EBITDA increased by $20.7 million to $21.4 million.”

In other words, it is slowly making money, at least from a cash flow perspective.

Expectations of revenue were pegged at just about $600 million this year and close to $300 million last year.

In the filing, Twitter said it had 215 million active users, or those that use the service at least once a month, sending out 500 million tweets daily. It said in December that it had 200 million.

As of midyear, Twitter said it had $164.4 million in cash or cash equivalents.

As to the big owners of Twitter, pre-IPO: CEO Dick Costolo with 7.6 million shares, co-founder and chairman Jack Dorsey with 23.4 million shares, co-founder and former CEO and director Evan Williams with 56.9 million shares. Director Peter Fenton held 31.6 million shares for Benchmark Capital.

The other big holders, called “5% Stockholders,” include, as I had previously reported: Rizvi Traverse, Spark Capital, Benchmark, Union Square Partners and DST Global.

Shares are expected to trade starting in November, which it can do after a 21-day period after the public filing. But it could also delay that, especially if markets suffer due to the recent government shutdown.

Twitter is far along in the IPO process, having filed financial information with the Securities and Exchange Commission in July. It has since been going back and forth with regulators on issues, confidentially, part of a filing process for companies with revenue of less than $1 billion under the Jumpstart Our Business Startups Act.

It released news of the filing in September via — of course — a tweet.

Twitter will now go on a public road show for investors, although it has been in talks with a number of them already as part of the process.

Here are the bankers, for those who care about such things (only the bankers): Goldman Sachs in the lead, with Morgan Stanley, J.P. Morgan, Deutsche Bank and Bank of America Merrill Lynch, as well as smaller players, Allen & Co. and Code Advisors.

Here is Twitter’s inevitable tweet about the filing:

Our S-1 will be filed publicly with the SEC momentarily. This Tweet does not constitute an offer of any securities for sale.

— Twitter (@twitter) October 3, 2013

And, in its short letter to potential shareholders from @twitter, the company said:

We started with a simple idea: share what you’re doing, 140 characters at a time. People took that idea and strengthened it by using @names to have public conversations, #hashtags to organize movements, and Retweets to spread news around the world. Twitter represents a service shaped by the people, for the people.

The mission we serve as Twitter, Inc. is to give everyone the power to create and share ideas and information instantly without barriers. Our business and revenue will always follow that mission in ways that improve–and do not detract from–a free and global conversation.

Thank you for supporting us through your Tweets, your business, and now, your potential ownership of this service we continue to build with you.

Yours,

And here is the full filing — a little duller than most — to read in its entirety:

RELATED POSTS:

- File Under #Finally: Twitter Unveils IPO, Showing Growing Revenue But No Profits

- At 215 Million Monthly Active Users, Twitter Has a Growth Problem

- How Twitter’s Ad Business Went Zero to $500 Million In Less Than Four Years

- Dick Costolo Makes $14,000 a Year in Take-Home Pay

- One Thing Twitter Won’t Have When It Goes Public: Two Classes of Shares

- Twitter Is Made for Mobile, but It Still Has a Mobile Ad Gap