Trulia Set to Hang a “For Sale” Sign on Its Stock

Trulia, the second-largest real estate listings site in the U.S., is expected to go public this week.

The San Francisco company’s shares could be priced as soon as tomorrow night, and start trading Thursday morning. Trulia is offering six million shares at $14 to $16 apiece, which, at the midpoint of that range, would raise $65.8 million in net proceeds to the company. That would also value Trulia at $461 million.

The San Francisco company’s shares could be priced as soon as tomorrow night, and start trading Thursday morning. Trulia is offering six million shares at $14 to $16 apiece, which, at the midpoint of that range, would raise $65.8 million in net proceeds to the company. That would also value Trulia at $461 million.

Trulia trails behind sector leader Zillow, which held a very successful IPO last year. Zillow sold shares at $20, and now trades near $43 a share, valuing the company at $1.24 billion, or nearly three times Trulia’s proposed value. Trulia is expected to trade on the New York Stock Exchange under the ticker symbol TRLA.

A third company in the space, Realtor.com, trades publicly under the corporate name of Move, Inc.

Morningstar analyst James Krapfel wrote in a note to investors that he believes Zillow is the better bet over the long term, although, in his opinion, both companies are poised to grow as more consumers and agents shift the house-hunting process online.

“We believe Trulia has a growing network effect that could keep upstart online competitors at bay, but believe Zillow’s larger network effect will allow Zillow to maintain its position as the primary home search marketplace,” Krapfel wrote in the note.

Last week, Zillow sued Trulia, alleging that its Trulia Estimates feature infringes on Zillow’s patent related to estimating the value for homes and properties. Zillow is seeking a permanent injunction against Trulia, damages and attorneys’ fees.

A Trulia spokesperson did not reply to emails seeking comment, which is standard practice during the IPO process.

A Trulia spokesperson did not reply to emails seeking comment, which is standard practice during the IPO process.

Trulia leveraged a new provision in the JOBS Act that allowed it to file for a public offering confidentially. It did not disclose any financials until 21 days before its road show, which perhaps has allowed it to fly under the radar, compared to other recent tech IPOs.

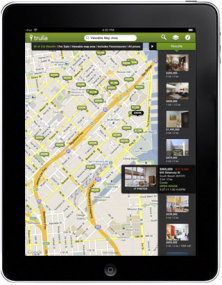

In the company’s online road show, Trulia highlighted its mobile strategy, saying that, unlike other recent companies that went public and have struggled, it is benefiting from the smartphone trend.

Trulia co-founder and CEO Pete Flint said mobile works for real estate because customers are often out spending the afternoon looking at open houses. Likewise, real estate agents are mobile professionals, conducting their business wherever they happen to be. Because of that, ads monetize better on mobile than they do on the Web, he said. For example, the company’s average revenue per agent is $167 a month on mobile versus $134 a month on the Web.

In 2011, the company nearly doubled its losses to $6.2 million from $3.8 million a year earlier, at the same time doubling revenue to $38.5 million.

Proceeds from the offering are expected to be used for working capital and general corporate purposes. Current shareholders, including Flint and other executives and directors, expect to sell one million shares in the offering.