Société Ridicule

We managed the existing book very well because we decided some time before the crisis to be long volatility and be less sensitive to correlation, so the losses were minimal. We suffered on our statistical arbitrage trading activity, but that was just for one month, and minimal compared to some hedge funds or other banks. Overall, our trading activities will be approximately flat compared to last year, which is a good performance.”—Christophe Mianné, Société Générale’s head of market activities, Jan. 2007

How ironic is it that Société Générale, the French bank responsible for the biggest fraud in investment banking history, was just this month named Equity Derivatives House of the Year by the financial risk-management magazine Risk? Yesterday, Société Générale, one of the pillars of European finance, revealed that a junior trader, identified as Jérôme Kerviel, had made massive bets in the futures market and cost it more than $7 billion.

How could it happen that a lone rogue employee could lose what essentially amounts to a year’s worth of profits without it being noticed, especially one that human resources officials at SocGen described as a “fragile individual without particular genius”? The bank says that each time Kerviel took a position one way, he would enter a fictitious trade in the opposite direction to mask the real one. Essentially, he created a secret second firm within the bank’s market rooms.

“He succeeded in building this hidden firm, in building his positions by hiding them by other positions that were totally fictional,” Société Générale CEO Daniel Bouton told reporters at a Paris news conference yesterday. “That is what is so extraordinary about this case.”

Indeed. Though not quite as extraordinary as how he managed to do it without detection. Said one bond trading firm CEO, “One hundred thousand euros! He was earning 100 grand and was allowed to take a 4.9 billion euro position? I don’t believe it.”

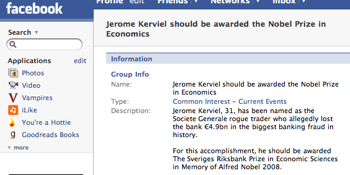

Believe it. Certainly the 415 of members of the “Jerome Kerviel should be awarded the Nobel Prize in Economics” Facebook group do.